Since the start of the pandemic, Southeast Asia has grappled with some of Asia’s most debilitating outbreaks. After a challenging 2020 replete with lockdowns, most countries struggled to start large-scale vaccination programs.

This left large swathes of the population exposed to mutations such as Delta, which has spread like wildfire. While Singapore and Malaysia should reach a 70% level of vaccination coverage (mostly mRNA) before year-end, this remains a far more distant prospect for the rest of ASEAN, leaving the region susceptible to this and future outbreaks.

No size fits all. Vietnamese and Malaysian policymakers have imposed the most stringent lockdowns, including curfews and granting few exceptions. Crucially, this means that pockets of their manufacturing sectors have seen significant disruptions, especially Vietnam, with its large electronics and textile sectors.

In Indonesia, the government has imposed the most stringent restrictions since the start of the pandemic, but the impact on mobility, and thus growth, has been softer than expected. Meanwhile, the latest restrictions in Thailand have had a relatively limited impact on mobility. Measures may need to be tightened to curb record cases.

Adjustments. Broadly speaking, data suggest that consumption should be more resilient in the face of restrictions and mobility reductions, thanks to growing e-commerce penetration and quicker fiscal disbursement. Still, HSBC makes downward adjustments to our growth forecasts given the duration of restrictions. Although uncertainty abounds, policymakers have recently provided guidance on the conditions for re-opening. HSBC uses this as the bedrock of our GDP assumptions.

Policy. Fortunately, inflation concerns in Southeast Asia have dissipated. Key food prices, such as rice, have fallen sharply (-30% y-t-d), helping to offset rising energy prices. Meanwhile, demand-driven inflation has subsided sharply. Notwithstanding lower inflation risks, we do not believe further rate cuts are in the offing. Fiscal policy remains the main line of defence, but credit rating concerns will continue to grow.

Recovery. Recovery prospects depend on future vaccination trends, export composition, and fiscal policy space. Singapore and Malaysia are best positioned, in our view, while Thailand and the Philippines have a long road ahead. As vaccinations accelerate and COVID-19 risks subside, investor focus will likely increasingly shift to the imminent elections in Malaysia, and 2022 presidential elections in the Philippines

Most of Asia – and indeed the world – is grappling with the spread of the Delta variant, but for ASEAN, the impact has been particularly severe (chart 1).

For one, vaccination rates are lower than the developed world and the rest of Asia. The timing is also troubling: Delta began to spread as most Indonesians and Malaysians observed Ramadan and celebrated Eid, including large gatherings and travel, exacerbating the spread. Only the Philippines, which was coming off of a previous wave, has yet to see a rise in cases, but that seems inevitable as test positivity increases.

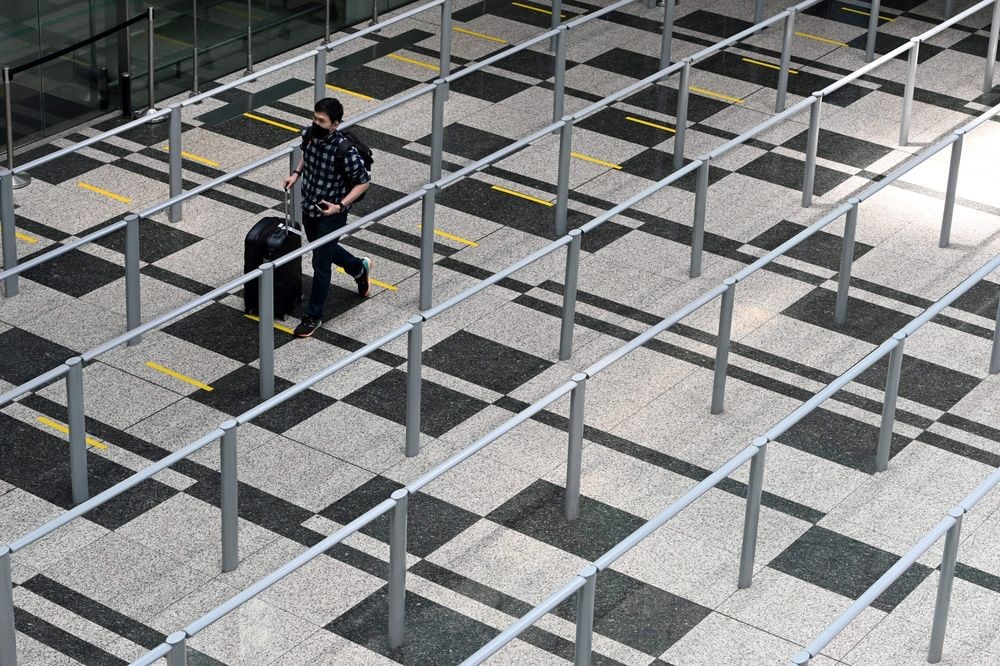

With the relentless spread and limited ICU capacity, policymakers resorted to lockdowns and restrictions. By the end of the July, most of Malaysia’s population will have been subjected to two months of lockdown – MCO – although restrictions have been eased in several states since early July.

Vietnam has also imposed lockdown conditions in most of the country in the last few weeks. Indonesia imposed fairly strict restrictions across Java, Bali, and 13 other cities in July, impacting c65% of the population. But the impact on mobility has not been as pronounced as expected, possibly reflecting enforcement in rural areas.

A still-high test positivity rate in Indonesia suggests the outbreak remains a concern, despite falling cases. Thailand’s measures, while broad on paper, have had a limited impact on mobility. Enforcement of curbs may thus need to be tightened as cases continue to rise and the country runs out of ICU capacity.